BlackRock, the colossal asset manager steering $10 trillion worldwide, just patted itself on the back for dominating the ETF scene with some of the quickest climbers ever seen.

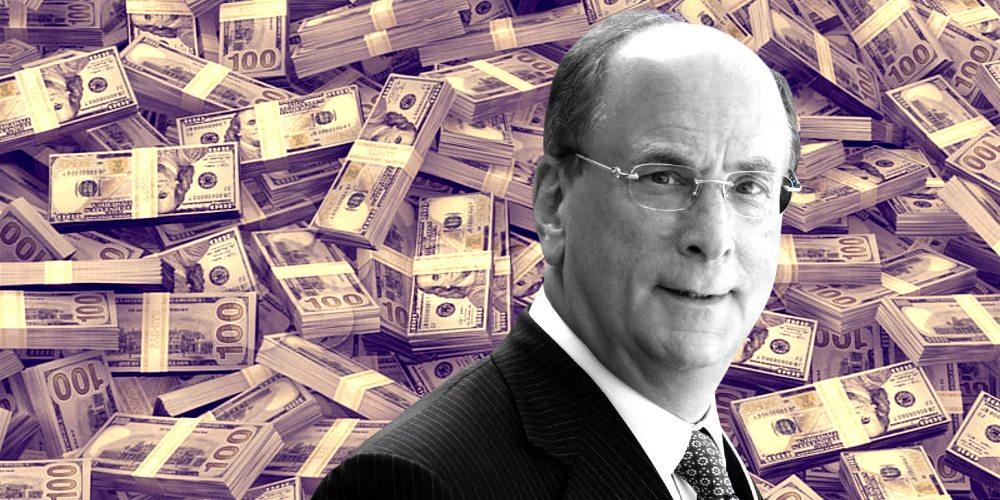

“Our digital assets ETPs and active ETFs have grown from practically zero to 10 in 2023 to over $100 billion in digital assets and over $80 billion in active ETFs,” said CEO Larry Fink during the company’s recent earnings call.

This surge positions BlackRock as a powerhouse in crypto investments, appealing to American savers looking for ways to tap into digital currencies without the hassle of direct ownership. The iShares Bitcoin Trust (IBIT) leads the pack as the biggest crypto ETF, with assets crossing $100 billion before a recent pullback tied to Bitcoin’s slide.

Bitcoin itself peaked at $126,272.76 on October 6, 2025, only to dip below $110,000 amid rising U.S.-China frictions that are rattling investor confidence. Meanwhile, gold surged to a new high of $4,280.20 per ounce, reminding folks why traditional safe havens still hold strong in uncertain times.

Not far behind, the iShares Ethereum Trust (ETHA) has pulled in about $16 billion in assets.

“Our flagship offerings in IBIT and ETHA were among the top five inflowing products in the ETP industry,” noted CFO Martin Small on the same call.

Ethereum has followed suit, dropping to around $3,800 from its August 24, 2025, high of $4,955.23. Yet both Bitcoin and Ethereum have gained roughly 14% this year, edging out the S&P 500’s 13% advance—a win for those betting on crypto’s role in bolstering American portfolios against inflation and global volatility.

BlackRock’s own stock has mirrored that growth, up 14% year-to-date, signaling robust demand from U.S. investors hungry for innovative funds that drive economic resilience at home. As these ETFs balloon, they underscore how American ingenuity in finance can counter globalist agendas by putting more control in the hands of everyday investors.

If investing in BlackRock cypto ETF’s show “..how American ingenuity in finance can counter globalist agendas by putting more control in the hands of everyday investors.” let me tell you how American ingenuity can make you believe men have periods, make a nation jump through covid hoops for years & how Facebook/Meta, Google, & Microsoft promote a free and open exchange idea across the Internet.