Americans can readily see the effects of record-high inflation every time they shop. Prices have soared, from the grocery store to the gas pumps. Although inflation has cooled, families are still feeling the pinch.

And the harm doesn’t end there: Inflation also is making stock markets appear stronger than they really are and cutting into returns for everyone, including those with retirement accounts.

-

The Importance of Prayer: How a Christian Gold Company Stands Out by Defending Americans’ Retirement

We seldom hear about that last point. When media outlets discuss the latest inflation rate, they typically highlight the average annual percentage change in the consumer price index. The CPI tracks a basketful of goods, including housing, food, energy, insurance, and more, measuring the average price increases of these items over time.

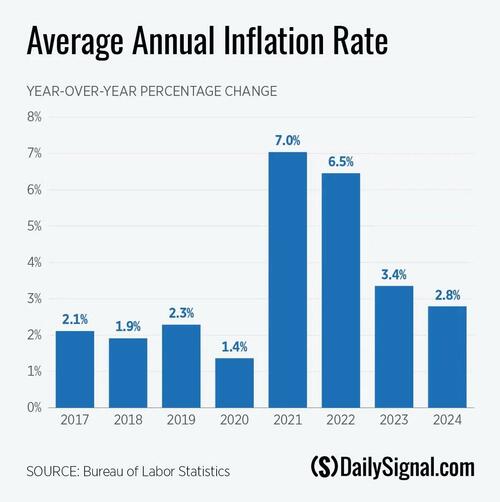

From 2016 to 2020, the inflation rate averaged 1.9 percent, which resulted in a cumulative price increase of about 7.7 percent over four years. The Federal Reserve’s target rate—about 2 percent—typically goes unnoticed by consumers, as wages tend to rise at a similar pace.

But from 2021 to the present, the inflation rate has averaged 4.9 percent, leading to a cumulative price increase of 19.6 percent. At these elevated levels, wages struggle to keep up, making inflation more noticeable for consumers. A recent poll revealed that 63 percent of voters say they believe the U.S. economy is on the wrong track and 62 percent characterize it as weak. […]

— Read More: www.zerohedge.com