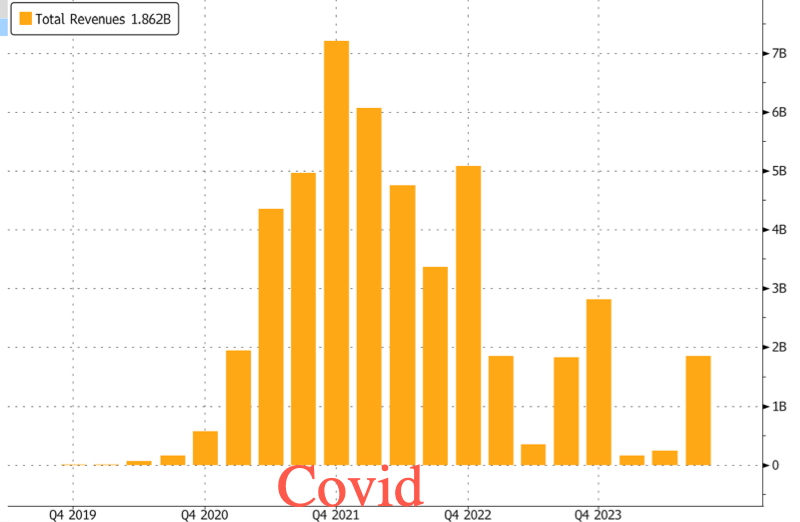

Shares of Moderna crashed in premarket trading after the company issued business and pipeline updates revealing sluggish demand for its Covid-19 and RSV vaccines. The weak sales environment forced the company to slash its 2025 full-year forecast, falling short of Wall Street’s average estimates.

Moderna released business updates and progress across its pipeline of mRNA medicines, plus outlooks on sales ahead of its presentation at the 43rd Annual JPMorgan Healthcare Conference at 3:45 PM.

The first disappointing update from the Cambridge, Massachusetts-based company was a downgraded sales forecast for 2025, which fell short of the average analyst estimate tracked by Bloomberg:

“In 2024, we achieved $3.0 – 3.1 billion in product sales, approval of our RSV vaccine and continued to adapt our COVID-19 business for the endemic setting,” Moderna CEO Stéphane Bancel wrote in a press release.

Bancel continued, “At the same time, we reduced our cash operating cost by over 25 percent compared to 2023 and aim to reduce 2025 cash costs by $1 billion with a plan for an additional $500 million cost savings in 2026. We remain focused on our three strategic priorities: driving sales growth, delivering up to 10 product approvals over the next three years, and reducing costs across our business.” […]

— Read More: www.zerohedge.com