While 99% of the media keeps staring at official data by the Chinese central bank (PBoC)—misleadingly stating it added 5 tonnes of gold in November following a supposed six-month pause—the PBoC’s “unreported” purchases in London accounted for a stunning 60 tonnes in September and another 55 tonnes in October.

And while cross-border trade statistics from the U.K. for November have yet to be released, I foresee another purchase of a similar magnitude.

Chinese authorities see a greater role for gold in the future international monetary system, or they wouldn’t continue buying such extraordinary amounts of gold. Via London alone, the PBoC has stockpiled 1,000 tonnes of gold since Russia’s foreign exchange assets were “frozen” by the West early 2022.

London Exports to China Are a Proxy for PBoC Buying

Since July this year, I have been writing that a large share of China’s gold imports into the domestic market is not bought by the private sector. We can conclude that the bars exported from the U.K. to China are secretly destined for the PBoC.

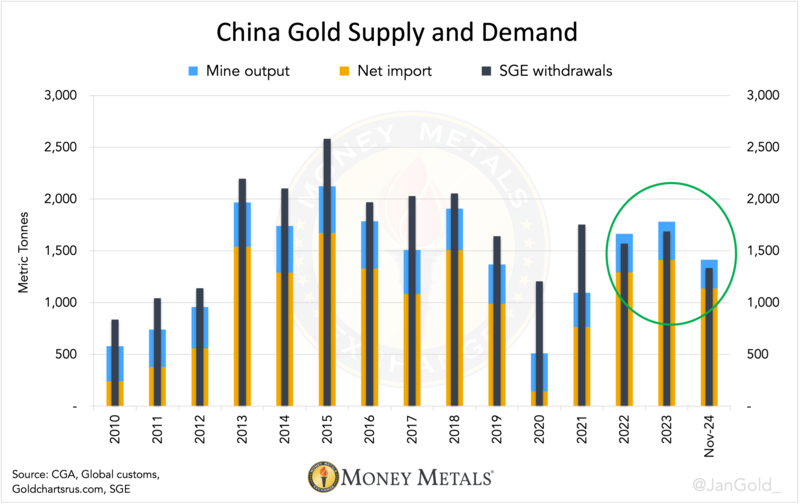

Initially, I based my analysis on a pronounced surplus in the Chinese domestic gold market—resulting from supply (mine, recycled gold, and imports) outstripping demand. The most conceivable explanation for this surplus is that the central bank of China is behind large gold imports. […]

— Read More: headlineusa.com