On January 17, the Congressional Budget Office (CBO) released its latest Budget and Economic Outlook and Update. It attracted little attention in a media environment flooded with stories about then-incoming President Trump, but it should have been one of the big stories of the year. The CBO takes stock of the incoming administration’s fiscal inheritance, and it is a grim one.

“[T]the federal budget deficit in fiscal year 2025 is $1.9 trillion,” the CBO notes, or “6.2 percent of gross domestic product (GDP).” This comes after a deficit of 6.6 percent of GDP for 2024 and is a staggering number for an economy which is, we are told, booming.

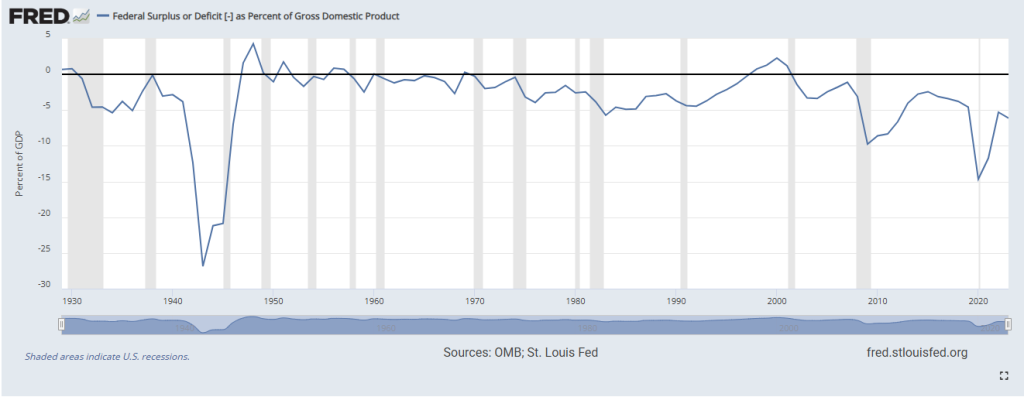

If we go back to World War Two, the only years when the Federal budget deficit has been higher as a share of GDP are the recession and slow recovery years 2009-2012 and the pandemic years of 2020 and 2021. What is worse is that, despite all the “Building Back Better” of the last few years, the Federal budget deficit has actually risen from 5.3 percent of GDP in 2022. Perhaps this vast infusion of borrowed money is why the economy is supposedly “booming.” If so, this sugar rush is not sustainable.

Looking ahead, the numbers do not improve. The deficit is forecast to hit 6.1 percent of GDP in 2035.

The result of these large, persistent, and growing deficits is a large and rapid increase in Federal government debt. “From 2025 to 2035,” the CBO writes:

…debt swells as increases in mandatory spending and interest costs outpace growth in revenues. Federal debt held by the public rises from 100 percent of GDP this year to 118 percent in 2035, surpassing its previous high of 106 percent of GDP in 1946. […]

— Read More: thedailyeconomy.org