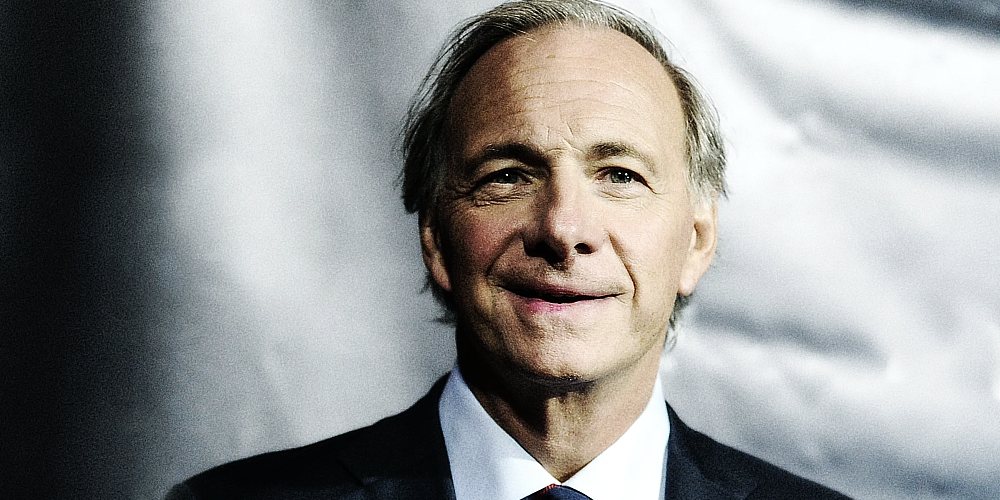

Ray Dalio, the founder of Bridgewater Associates, the world’s largest hedge fund, has issued a stark warning about the U.S. economy, likening it to a “death spiral” due to its burgeoning national debt. Speaking on “The All-In Podcast” with co-host David Friedberg, Dalio highlighted the dire implications if both political parties fail to address the growing deficit.

Dalio described the current economic situation as one where the U.S. government is in a “death spiral,” a term typically used when a company or government has such high levels of debt that it must borrow just to service that debt. He pointed out that this scenario is driving credit quality down and pushing interest rates up. According to him, the crucial question is whether the debt generates enough income to manage these issues effectively.

The hedge fund titan warned of an “economic debt heart attack” if the U.S. does not curb its spending. He explained that a large debt necessitates buyers for that debt. When there’s an imbalance between supply and demand for U.S. debt, the Federal Reserve might have to print more money to buy it, leading to inflation and a decrease in the debt’s value. If they don’t, interest rates will rise, reducing borrowing, and potentially stifling economic growth.

Despite efforts to lower interest rates, the markets have reacted by marking down U.S. Treasuries, causing long-term interest rates to spike to levels not seen since before the 2008 financial crisis. The U.S. operates with a nearly $2 trillion annual deficit, which is about 7% of GDP, while paying over $1 trillion yearly just in interest on existing debt.

Dalio emphasized the need for immediate action, suggesting that the deficit should be reduced from 7.5% to 3% of GDP to avoid further economic strain. He stressed that Department of Government Efficiency (DOGE) needs to manage this, acknowledging that such measures would likely intensify political divisions.

The Economic Policy Innovation Center (EPIC) has projected that without changes, the U.S. might reach its debt ceiling by June 16, 2025, which could force the government into default or necessitate harsh spending cuts. This situation underscores the urgency for bipartisan cooperation to address what Dalio and others see as an impending economic crisis.

Dalio’s warning serves as a wake-up call for policymakers to act decisively on reducing national debt. The metaphor of an economic “heart attack” vividly captures the potential severity of inaction, urging Democrats who oppose DOGE’s efforts to stand down.

Article generated from legacy media reports.

-

Learn the TRUTH about Gold IRAs and how most precious metals companies play dirty.