By Jesse Colombo, author of TheBubbleBubble

(Zero Hedge)—Following more than two months of stagnation after the U.S. presidential election, gold is now breaking out decisively, signaling its readiness to resume its rally toward $3,000 and beyond. While this recent pause has tested the patience of many investors, I’ve consistently maintained that it was a healthy consolidation phase, paving the way for even greater gains. Now, as I’ll demonstrate with numerous charts, gold is breaking out of its post-election trading range across nearly every major currency, reaffirming its bullish momentum.

In my view, the most important gold chart to monitor is the COMEX gold futures chart, priced in U.S. dollars. Over the past few months, a triangle pattern has taken shape—a formation that is typically a continuation pattern, suggesting the uptrend preceding it is likely to persist. Today, gold broke out of this triangle, an encouraging development. Notably, as I recently explained, a similar triangle formed in late 2007, and its breakout signaled substantial gains in the ensuing months.

To fully confirm that today’s breakout is genuine, I’m looking for a decisive, high-volume close above the key $2,800 resistance level. Breakouts above horizontal resistance levels carry greater validity than those above diagonal ones, making this milestone particularly significant. The $2,800 resistance level holds particular significance as it marked gold’s peak in late October before the recent pullback. Additionally, it serves as a key psychological level, reinforcing its importance in the eyes of investors.

The next critical chart to watch is gold priced in euros. This chart is particularly informative because it eliminates the influence of U.S. dollar fluctuations, providing a clearer view of gold’s intrinsic strength. Over the past two months, gold priced in euros has outperformed gold priced in U.S. dollars, largely due to the dollar’s strong rally, which has made gold seem weaker than it truly is. Just a few days ago, gold priced in euros closed above the key €2,600 resistance level—an all-time high—delivering a strong bullish signal.

Gold priced in Swiss francs recently closed above its 2,440 resistance level to hit an all-time high. This chart deserves close attention, as Switzerland plays a pivotal role in the global gold industry. With its renowned mints, world-class refiners, and a robust gold trading and banking sector, Switzerland remains an important hub for the international gold market, as I recently explained.

The chart below shows gold priced in euros, British pounds, and Swiss francs. I find that this particular mix shows gold’s movements very clearly. Gold priced in this mix of currencies recently closed above the key 7,200 resistance level signaling that the yellow metal’s bull market is ready to continue once again.

Gold priced in Canadian dollars recently broke out of a triangle pattern, signaling bullish momentum. For further confirmation, I’m looking for a decisive close above the horizontal 3,900 resistance level. This chart holds particular significance as Canada ranks among the world’s top gold producers, claiming the fourth spot globally with 200 metric tons of gold produced in 2023.

Gold priced in Australian dollars close above the key 4,250 resistance level, signaling a highly bullish development. Australia is the world’s second largest gold producer with 310 metric tons of gold produced in 2023.

China’s gold benchmark, the Shanghai Futures Exchange (SHFE) gold futures, closed above the critical 640 resistance level on Thursday. As the world’s largest producer of gold—producing 370 metric tons in 2023—and one of its largest consumers, China plays a pivotal role in the global gold market. For months, I’ve theorized that a resurgence of Chinese gold futures traders—who were instrumental in driving gold’s surge in March and April—could be the catalyst to propel prices toward $3,000 and beyond. I believe that today’s bullish breakout will turn that forecast into reality.

-

The Importance of Prayer: How a Christian Gold Company Stands Out by Defending Americans’ Retirement

Gold priced in Singapore dollars recently broke out of a triangle pattern, signaling bullish momentum. For further confirmation, I’m looking for a decisive close above the horizontal 3,700 resistance level. This chart is particularly noteworthy, as Singapore is a key regional gold trading hub with growing influence in the global gold market. Its strategic position and expanding role in the gold industry make gold priced in Singapore dollars an important indicator to watch.

Gold priced in Hong Kong dollars also broke out of a triangle pattern, issuing a bullish signal. For further confirmation, I’m looking for a convincing close above the horizontal 21,600 resistance level. Like Singapore, Hong Kong serves as a major global banking and gold trading hub, making this chart worth monitoring.

Gold priced in Indian rupees is another important chart to monitor, as India, like China, is one of the world’s largest gold consumers. Gold priced in Indian rupees recently broke out of a triangle pattern and is now in the process of breaking above the 234,000 resistance level.

Gold priced in Japanese yen is still trading in a range between 390,000 and 428,000, but is likely to soon experience a breakout of its own as gold’s bull market heats up once again.

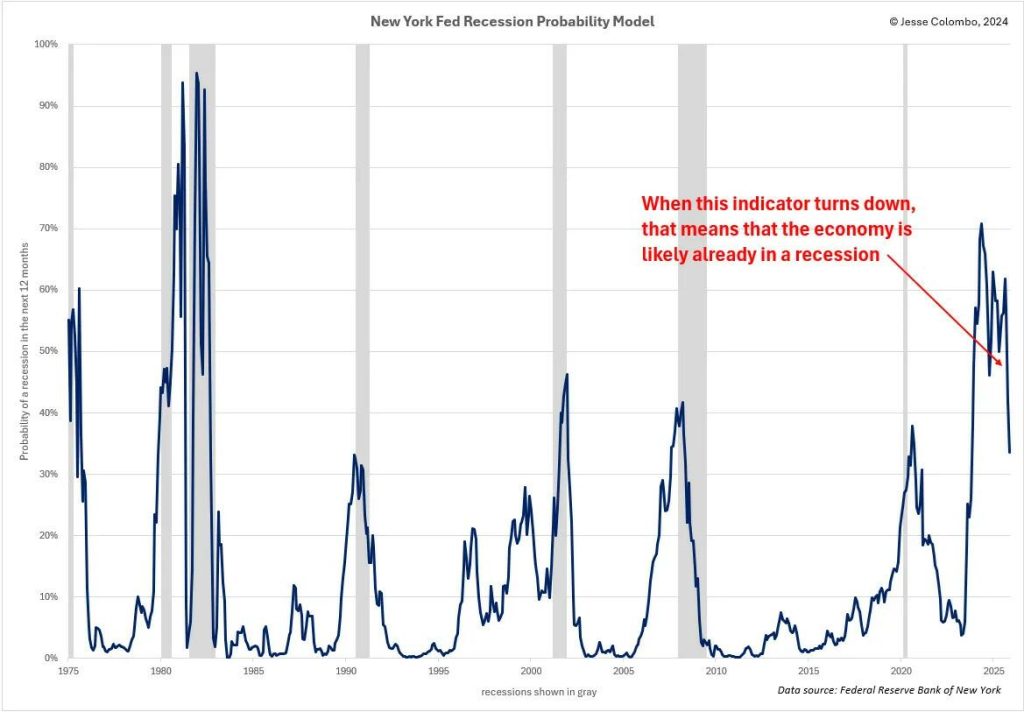

One key reason gold’s bull market is gaining momentum again is the increasing risk of a U.S. recession. Recessions are typically bullish for gold, as they lead to interest rate cuts and quantitative easing (QE)—essentially digital money printing. To explore the growing risk of a U.S. recession and its expected bullish impact on gold, be sure to read my related report.

There are other reasons to believe that gold’s bull market is still quite young. For example, there is a strong tendency for gold to continue to rise strongly after the first fed funds rate cut in a rate-cutting cycle. As the In Gold We Trust report aptly stated, “rate cuts are like rocket fuel for gold.” The report showed that over the past three rate-cutting cycles, gold has risen an average of 32% within two years of the initial rate cut. If gold follows a similar trajectory this time—following the Fed’s rate cut on September 18—it could rise to $3,380, representing a 25% increase from its current level of $2,714.

Another key reason gold’s bull market is still in its infancy is the massive bubble in the U.S. stock market, which will end in a significant bear market. This downturn will lead to a substantial transfer of capital from stocks into gold, as I explained recently. Notably, the Dow-to-gold ratio broke below its uptrend line in the spring of 2024, signaling that the rotation of capital from stocks to gold has already begun. This shift will gain momentum as the stock market bubble inevitably bursts.

In conclusion, gold is undergoing a significant breakout from its recent consolidation period, signaling the continuation of its bull market. This rally is poised to propel gold to $3,000 and much higher as the global paper money experiment inevitably unravels. Additionally, inflated asset prices, such as U.S. stocks, are destined to correct sharply, driving a massive shift of capital into safe havens like gold. While many investors remain bored or pessimistic about gold, now is the time for optimism. The outlook for gold is exceptionally bright, offering a promising opportunity for those paying attention.

If you enjoyed this article, please visit Jesse’s Substack for more content like this.

Trump Denies “Fake News” Report on Changes to Economic Plans

by Publius

President-elect Donald Trump has refuted a Washington Post report suggesting his aides were considering a more restrained tariff policy. The report claimed that Trump’s transition team was contemplating a tariff plan that would be less extensive than his campaign promises, targeting only imports deemed critical to national or economic security….

Gold Breaks Out With Central Bank Surge and Interest Rate Drops Expected

by Sponsored Post

Precious metals are seeing gains once again following the post-election dip, just as many economists had expected. Even China, which had been holding back for five months, returned to purchasing massive quantities of gold. “Falling U.S. interest rates and ongoing solid demand from central banks are supporting the gold price,”…

JPMorgan: “Debasement Trade” Into Bitcoin and Gold Is Here to Stay

by Tyler Durden, Zero Hedge

(Zero Hedge)—The so-called “debasement trade” into gold and Bitcoin is “here to stay” as investors brace for persistent geopolitical uncertainty, according to a Jan. 3 research note by JPMorgan shared with CoinTelegraph. Gold and BTC “appear to have become more important components of investors’ portfolios structurally” as they increasingly seek to…

Hochul to Increase Payments to a Program That Serves Illegals

by Independent Sentinel

Welfare champion Gov. Kathy Hochul of New York has proposed a huge expansion of the state’s child tax credit. People here illegally can collect. New York is a one party state and Hochul runs it like a dictator. Hochul wants taxpayers to pay for an increase in the maximum credit…

More Details Emerge Regarding the Plan to Kill a Supreme Court Justice

by Zachary Stieber, The Epoch Times

(The Epoch Times)—A California man allegedly told authorities that he flew to the East Coast to kill Supreme Court Justice Brett Kavanaugh, according to newly filed court documents. Nicholas Roske flew across the country from California to Virginia on June 7, 2022, landing just before midnight. He got into a…

Kevin O’Leary Wants to Save TikTok by Buying It and Rewriting Its Algorithm

by The Blaze

“Shark Tank” investor Kevin O’Leary said that he was working on a deal to save the popular TikTok social media platform from being banned in the U.S. over privacy concerns. Republican lawmakers have banned TikTok from being used by state and federal employees after numerous reports that the platform collects…

AI Chatbots Credited With Surge in US Holiday Sales

by Valuetainment

AI-powered tools, particularly chatbots, significantly boosted online holiday sales in the US to $282 billion in 2024, a nearly 4% increase from the previous year, according to Salesforce. Globally, online sales reached $229 billion, up from $199 billion in 2023, as retailers utilized targeted promotions and personalized recommendations to attract…

Dana White Has Joined Meta’s Board of Directors

by Cactus Williams, Discern Report

UFC CEO and long-time friend of Donald Trump, Dana White, has joined Meta’s board of directors alongside Charlie Songhurst and John Elkann. This is just the latest in a series of decisions Meta has made following Trump’s historic electoral victory which seemed to be aimed at cozying up to the…

The Biggest Sale on Beef With 25-Year Shelf-Life EVER

by Sponsored Post

Let’s cut to the chase. Prepper All-Naturals is offering an unprecedented 40% off for its “Beef Steak” survival bags with promo code “steak40”. With a 25-year shelf life and a single ingredient (beef, of course), our most popular product is available for a very limited time with the biggest discount…

McDonald’s to Abandon Diversity ‘Goals’ in Hiring, to Stop Participating in Woke Non-Profit’s ‘Corporate Equality Index’

by The Post Millennial

Filmmaker and cultural commentator Robby Starbuck has gained another scalp in his effort to flip US corporations away from woke agendas focused on DEI, diversity, equity and inclusion. “BIG news,” Starbuck reported on X. “McDonald’s is ending a number of woke DEI policies today. Now let me tell you what’s…